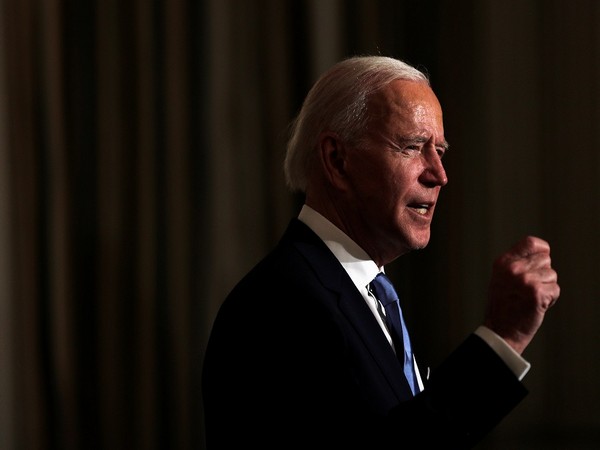

The Bombay Stock Exchange Sensex made history on Thursday. The index crossed the record level of 50 thousand for the first time. The positive effect of the new President Joe Biden assuming office in the US was also reflected in the domestic stock market. However, the market lost its lead later in the afternoon and the index finally closed 560 points below the day’s high.

The Sensex slipped to 25,638 on March 24, after the lockdown was announced due to Corona last year. After that, it has crossed the 50,000 level in just ten months. Meanwhile, the market cap of listed companies in the BSE is also increased. The increased cap is 380% higher than the government’s corona relief package announced in May last year of Rs 20 lakh crore.

Market slipped after initial growth

The Sensex closed down 167.36 points at 49,624.76 from yesterday’s closing. However, the index also touched an all-time high of 50,184. The BSE traded at 3,188 shares. The market cap of the listed companies has also gone up to Rs 197.08 lakh crore, which crossed Rs 199 lakh crore for the first time in the morning.

Nifty crosses 14,750 for the first time

The Nifty index closed at 14,590.35, down 54.35 points due to increased selling later in the afternoon. However, the index rose to 14,753.55 for the first time in its early lead, also its all-time high. Metal and banking stocks led the market decline. Nifty Bank index closed down 1.10% and Metal index 2.18%.

The market had gained for the second consecutive day yesterday due to heavy foreign investment and strong global cues. The Sensex was up 393.83 points at 49,792.12 and the Nifty was up 123.55 points at 14,644.70.

Now in the coming days, the impact of the Union Budget will be seen on the market, under which huge fluctuations can be seen. In such a situation, investors will be advised to buy in the fall. It will have commodities and auto companies in focus. They have given a target of 51,750 to the Sensex.

Reasons behind such soar

- Joe Biden is the new president in America. Investors expect the new relief package to be approved soon.

- Foreign institutional investors (FIIs) continue to invest. According to NSDL, so far in January, Rs 20,236 crore has been invested.

- Strong moves against the Pandemic. There are frequent positive updates about vaccination in the country.

Also read: Biden & Harris usher in a New Era of American Diplomacy

Boom Asian markets

The swearing in of new President Joe Biden in the US led to a spectacular growth in global markets. On Thursday, Korea’s Kospi index closed 1.49% and China’s Shanghai index closed up 1.07%. Similarly, Japan’s Nikkei index closed up 0.80%. While Hong Kong’s Hangseng index closed down 0.07% high. On the other hand, the Nasdaq index closed up 1.97% and the S&P 500 index was up 1.39% in US markets yesterday. Apart from this, an increase was also recorded in the European market.