In her budget speech, the Finance Minister said that the budget of 2021-22 rests on 6 pillars. The first pillar is health and welfare, the second – physical and financial capital and infrastructure, the third – inclusive growth for ambivalent India, innovating human capital, the 5th – innovation, research and development, the 6th pillar – minimum government and maximum governance. Here are the Highlights of new budge:

Education sector

- Major announcements in the field of education, Commission for higher education to be opened, 100 new military schools to be opened.

- Central University of textile will be opened in Leh.

- The Finance Minister said that 100 new Sainik Schools will be set up in partnership with NGOs, private schools and states.

- A Central University will be set up in Leh for higher education in Ladakh.

- The Finance Minister said that the new National Education Policy has been wholeheartedly accepted.

- A Commission for Higher Education will be set up.

Health Sector

Also read: FM Unveils New ‘PM Aatmanirbhar Swasthya Yojana’

- 35,000 crore will be spent on the corona vaccine in 2021-22. If needed, more funds will be given.

- Nutrition will also be given attention. Mission Nutrition 2.0 will be launched.

- Will also increase Potable water supply. 2.87 lakh crores will be spent in 5 years. Jal Jeevan Mission will be launched for urban areas.

- The pneumococcal vaccine will be introduced nationwide. With this, the lives of 50 thousand children will be saved every year.

- PM Aatmanirbhar Swasthya Yojna will start with a budget of 64,180 crores. This budget will also be used for the treatment of new diseases.

- This will help the wellness centers of 70 thousand villages. Critical care hospitals will be started in 602 districts. The National Center for Disease Control will be strengthened.

- Integrated Health Information Portal will be launched to connect public health labs.

- 15 health emergency operation centers will be started along with 9 Bio Safety Level 3 labs.

Railway

- Railways has formulated National Rail Plan 2030 so that future ready railway system can be built and logistics cost can be reduced.

- By June 2022, the Eastern and Western Dedicated Freight Corridor will be ready.

- The Somnagar-Gomo section will be built in PPP mode.The Gomo-Dankuni section will also be built in a similar manner.

- Future Ready Corridors will be built at Kharagpur-Vijayawada, Bhusaval-Kharagpur, Itarsi-Vijayawada.

- There will be 100% broad gauge electrification by December 2023.

- Vista Dome coaches will start so that passengers have a good experience.

- Train protection systems will be introduced on high density network, high utility network. These systems will be made in the country.

- 1.10 lakh crore rupees are being given to the Railways. Out of which 1.07 lakh crore rupees is for capital expenditure only.

Agriculture

Also read: Water Intensive Agriculture Is ‘Elephant In The Room’

- In the budget, the government has increased the limit of agricultural loan. The government has set a target of giving loans up to 16.5 lakh crore to farmers this time. Every time the government increases the target of agricultural loans in the budget. For the year 2020-21, a target of agricultural loan of Rs 15 lakh crore was set. This time, in view of the atmosphere prevailing in the country against the agricultural laws, the decision of the Modi government is considered to be very important.

- Operation Green Scheme will cover 22 perishable crops.

- APMC will also have access to the Agriculture Infrastructure Fund. More mandis will be connected with e-agriculture market.

- 5 big fishing harbors will be built in cities such as Kochi, Chennai, Visakhapatnam, Paradip and Petuaghat. Multipurpose Sea-Vid Park to be built in Tamil Nadu.

FDI in Insurance sector

While presenting the budget, Union Finance Minister Nirmala Sitharaman announced that the investment limit in the insurance sector has now been increased to 74 percent. Earlier this limit was only 49 percent. In addition, a charter has been announced for investors.

Finance Minister Nirmala Sitharaman said in the budget speech for the financial year 2020-21 that the government could increase the FDI limit in the insurance and pension sector. The Insurance Regulatory and Development Authority of India (IRDA) has also supported the proposal to raise the FDI limit to 74 per cent in the insurance sector.

Digital India

Finance Minister said that a provision of Rs 3700 crore has been made for Digital India. This allocation will be used for the promotion of digital payments in the country. The Finance Minister said that during the year 2021-22, Data Analytics, Artificial Intelligence, Machine Learning driven MCA 21 version 3.0 will be launched.

Disinvestment

The Finance Minister said that BPCL, Air India, Shipping Corp, Container Corp and other disinvestments will be completed this year. She said that the IPO of LIC will come in FY 2021-22. Sitharaman said that NITI Aayog will prepare a list of government companies that will be disinvested in the next phase.

Infrastructure

A Financial Institution is needed for the infrastructure sector development. A bill will be brought for this. 20 thousand crores will be spent on this so that a landing portfolio of 5 lakh crores rupees can be made in 3 years. The focus will be on monetizing the public infrastructure. National monetization pipeline will be launched. A dashboard will be made to see the progress being made in this case.

National highways authorities will also attract international investment. Railways will also monetize the freight corridor. Monetization will be taken care of in newly developed airports.

Census 2021

The Finance Minister said, “The new census will be the first digital census. It will cost Rs 3768 crore this year.

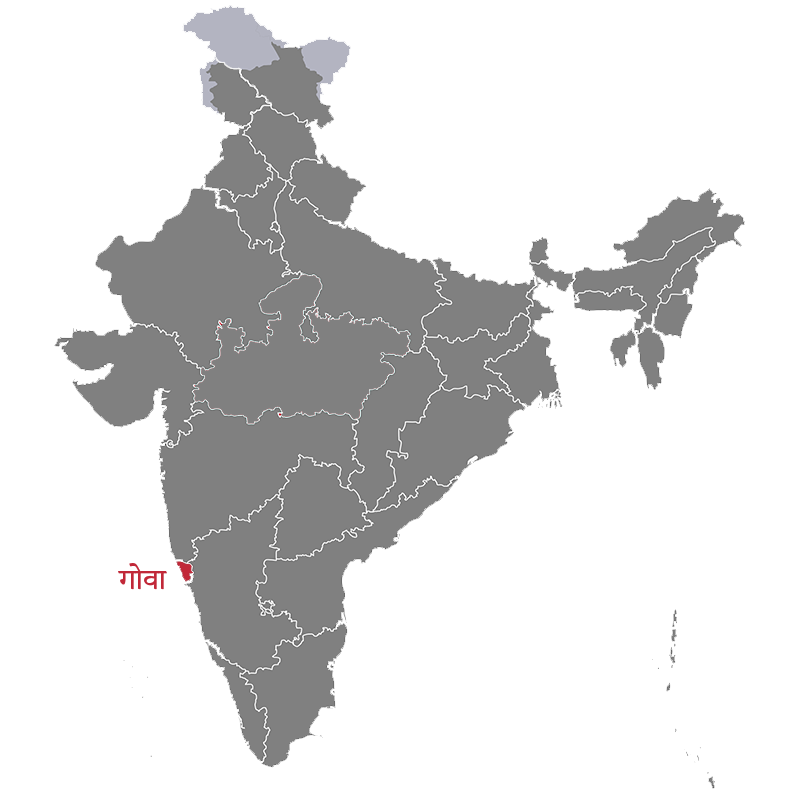

Diamond Jubilee of Goa

Goa is celebrating the Diamond Jubilee Year of Independence from Portugal. Rs 300 crore will be provided for celebration of this.

Tea Plantation Workers

1000 crores to be given to women tea workers of Assam and Bengal.

For the poor section

- One Nation, One Ration Card will be implemented in 32 states and UTs. 86% people have been covered in it.

- The benefit of the Ujjwala scheme will be extended to 1 crore more women.

Vehicle Scrapping

Voluntary vehicle scraping policy will be introduced so that old vehicles can be removed. This will help reduce pollution. Trains will have fitness test. Personal vehicles will be scraped after 20 years and commercial vehicles after 15 years.

Fiscal Deficit Target

The Finance Minister said that we have increased government spending after the end of the lockdown. Government expenditure of Rs 30.42 lakh crore was estimated in 2020-21, which increased to Rs 34.5 lakh crore. The fiscal deficit is 9.5% of GDP in 2020-21. To compensate for this we need 80 thousand crores more. For this we expect from the market. Government expenditure is estimated at Rs 34.83 lakh crore in 2021-22. The fiscal deficit is projected to be 6.8% of GDP in 2021-22. Would like to reduce it to 4.5% by 2025-26.

Banking

20,000 crores will be infused in public sector banks, asset reconstruction company and asset management company will be formed to tackle the problem of NPAs.

Contingency Fund

There is a provision to increase the contingency fund from 500 crores to 30 thousand crores.

Cess on Petrol

Agri-cess of Rs 2.5 on petrol and Rs 4 on diesel is proposed by FM.