Mutual fund popularity among investors has increased manifold since the last decade. In such a situation, if you are also planning to invest in it, then you need to understand some basic things before investing. If you are going to invest in a mutual fund through an agent, then your agent may not give you complete information. It is often seen that the new investor has incomplete information about its investment. There are some important things to keep in mind to invest in mutual funds and get better returns.

Also read: Looking For Good Investment Options; Here Are 2 Upcoming IPOs In Which You Can Invest

Decide, where to invest money?

The investor should first prepare the investment list where and how much money he has to invest. This process is called asset allocation. Asset allocation is the method that determines how to invest your money in various investments that have the right mix of all classes of assets. There are some rules of asset allocation that tell you how much money to raise at what age. It tells you how much to invest in Debt and Equity Market.

Higher the risk, higher the return will be

The reality is that every person’s circumstances and financial conditions are different. To understand asset allocation, you should have information like age, occupation, number of family members dependent on you, etc. The younger you are, the more risky you can take, which can give you better returns.

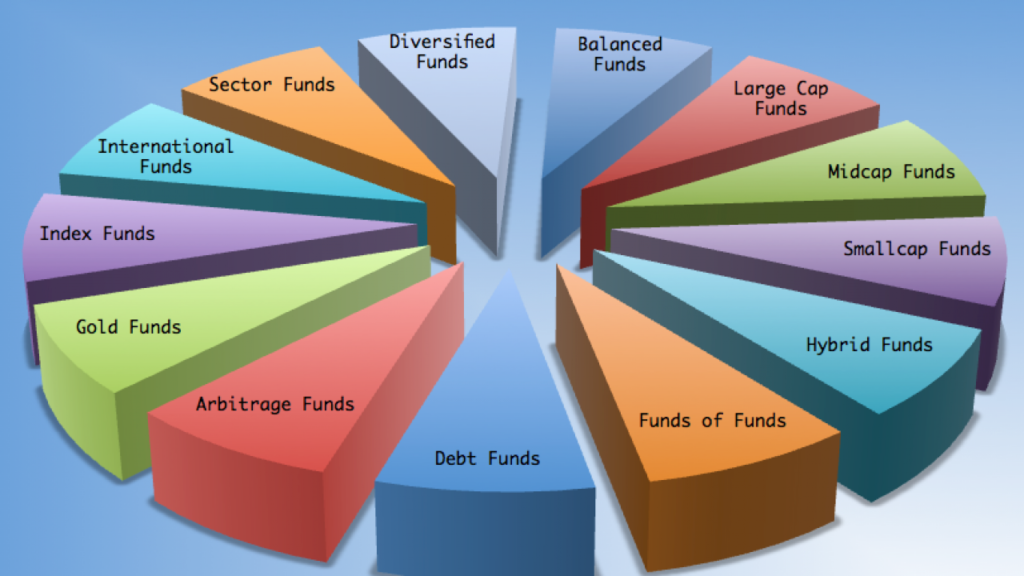

Choose the right fund

You choose the fund that suits your needs. For this, first, decide your financial goal, and then invest accordingly. Before investing, you should decide which fund to invest in. All types of funds are good for investment. It is necessary to keep information about them.

Terminating investment is not wiser

Many times it is seen that people withdraw money from the scheme in odd times or other fluctuating times like COVID-19 period. But investment should not be based on fear and greed. For this, investors should follow the path of Asset Allocation or Balanced Advantage category of mutual funds. A Balanced Advantage Fund is a scheme of mutual funds that invests in equity, debt and arbitrage.

Diversity in the portfolio is important

A portfolio should include multiple asset classes. Diversity protects you from the ill effects of the poor performance of any specific class. Sometimes the performance of a company or sector is worse than the rest of the market. In such a situation, if you have not invested all your money in it, then it acts as a shock absorber for you.

A safe investment is also necessary

Investing money in mutual funds can be risky. In such a situation, besides investing in it, it is also important to keep investing in safe options, where there is no risk. For such investments, you can invest in Public Provident Fund (PPF), Fixed Deposit (FD) or Recurring Account (RD).

Tracking the performance of your fund

After investing, do not be careless like sitting at home and forgetting it. For this, it is important to keep track of how your investment is doing. For such information, mutual funds publish monthly and quarterly fact sheets and newsletters containing reports on portfolio information, schemes managed by the fund manager, and their performance data. Apart from this, the performance data, daily NAV (net asset value), fund fact sheet, quarterly newsletter and press clippings are available on the mutual fund’s website.